Value Added Tax or VAT is an indirect tax on goods and services at each stage of production or distribution, ultimately borne by the end consumer. 📦 Like other European Union countries, Estonia applies VAT on most goods or services sold 💰 domestically. Eesti Firma, a recognized expert in company formation in Estonia and accounting services, shares detailed insights and professional guidance regarding the Value Added Tax and VAT number on this page.

VAT in Estonia: Registration, Rates, and Compliance

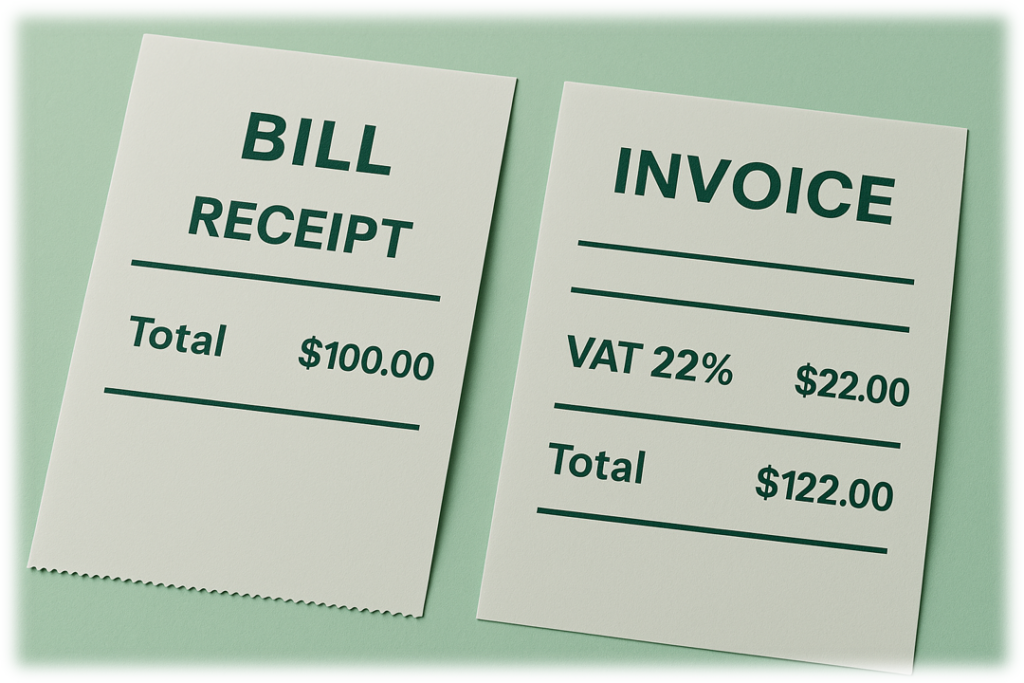

Businesses charge VAT on their sales and can usually deduct the VAT paid on business purchases (input VAT). 📊 VAT in Estonia is governed by the Estonian Value Added Tax Act (aligned with the EU VAT Directive 2006/112/EC) and administered by the Estonian Tax and Customs Board – the national tax authority. 🛒

The article offers a thorough overview of Value Added Tax (VAT) registration in Estonia, ✅ including information on how to get a VAT number, the relevant VAT rates, and the requirements that companies must meet after registering. Additionally, it emphasizes the significance of VAT compliance and provides support services for businesses looking to successfully negotiate the Estonian VAT system.

What is a Value Added Tax?

Value Added Tax (VAT) is a widely used consumption tax applied to the sale of goods and services in most countries, including Estonia. 🏛️ It is an indirect tax collected from the end consumer, calculated as a percentage of the final price. At each stage of the supply chain—production, distribution, and retail 🔄—VAT is added to the value of goods and services.

In Estonia, a business must register for VAT once its taxable turnover exceeds 40,000 euros within a calendar year. 📅 However, a company can also register voluntarily before reaching this threshold if VAT registration is beneficial or necessary due to its business model—for example, in cases of international trade, distance sales, or when working with VAT-registered partners. 🌐

VAT Number Registration in Estonia

In order to obtain a VAT number 📍 for an Estonian company, a VAT registration application must be submitted to the Estonian Tax and Customs Board. The application can be filed through the Board’s electronic environment using a 💻 secure electronic signature—via ID card, e-Residency, or Mobiil-ID. 🔐

Alternatively, it may be submitted in person at a local tax office in Estonia or remotely through an authorized legal or accounting representative holding a power of attorney. 💼

Applying for the VAT in Estonia

The VAT registration process in Estonia can be straightforward—if everything is prepared correctly. Our experienced team 👨💼👩💼 will ensure your application is complete, compliant, and professionally submitted—whether you’re registering from Estonia or abroad. 🌍

We’ll handle communication with the Tax and Customs Board, prepare supporting documents, ✉️ and respond to any additional questions on your behalf.📄

Want to save time and avoid stress? 💡 Contact us today, and we’ll take care of your VAT registration from start to finish. 🚀

VAT Rates in Estonia

Estonia applies multiple VAT rates to goods and services, each determined by the nature of the transaction. Understanding these rates—standard, reduced, zero-rated, and exemptions—is crucial for businesses to accurately calculate VAT, ensure compliance, and optimize their financial planning.

Below, you’ll find detailed explanations of each VAT category, helping you identify precisely which rate applies to your products or services in Estonia.

Standard VAT Rate – 24%

This standard rate (raised from 20% as of 2024) applies to most taxable goods and services in Estonia. For example, standard-rated items include general retail goods, professional services provided, and most business transactions not qualifying for a reduced rate or exemption.

Reduced VAT Rate – 9%

A reduced rate of 9% applies to certain goods and services under specific conditions. For instance, books and educational materials, prescription medications, press publications (such as newspapers and periodicals, in some cases), and hotel and other accommodation services (often including breakfast) have traditionally been taxed at 9%. (Some publications in physical or electronic form have even enjoyed a super-reduced rate of 5% in recent times.)

Please note that certain cases are subject to change – for example, the VAT rate on accommodation services and some press publications is scheduled to increase (from 9% to 13%) starting in 2025 as part of recent tax amendments.

Zero Rate – 0%

A 0% VAT rate (effectively an exemption with the right to deduct input VAT) applies to certain transactions, chiefly those involving international or intra-community trade. Intra-Community supplies of goods (sales to VAT-registered buyers in other EU member states) and export of goods to non-EU countries are taxed at 0%.

Additionally, specific services like international transportation of goods, and certain goods such as investment gold, are taxed at 0% or exempt by special provision of the EU VAT Directive.

VAT-Exempt Transactions

Some goods or services are exempt from VAT (no VAT is charged to the customer, and the supplier generally cannot deduct input VAT related to those supplies). Exempt categories in Estonia include many social services and public interest activities – for example, healthcare and medical services, educational services, financial and insurance services, and the sale or rent of certain immovable property (real estate).

The supply of these goods or services is not subject to VAT at all. In certain conditions, taxable persons may opt to tax an otherwise exempt transaction (for instance, sale of real estate or land) if it grants the right to deduct input VAT – the tax authority must be notified and certain conditions must be met as per the VAT Act.

Estonia’s VAT system operates within the EU single market rules. Being part of the EU customs union, there are no customs duties on goods moving between Estonia and other EU countries, but VAT still applies on these intra-community supplies and acquisitions.

For imports from outside the EU, import VAT is levied (usually at the standard rate) by the Tax and Customs Board at the point of entry; a registered business can later reclaim this import VAT on its VAT return, so long as the imported goods acquired are used for taxable supplies of the business.

Who Needs to Register for VAT in Estonia?

Not every company operating in Estonia must register for VAT right after incorporation. Instead, VAT registration depends on your specific business circumstances, including turnover levels, types of transactions, and whether you’re trading within the EU or internationally.

Understanding when registration is obligatory—or strategically beneficial—helps ensure compliance, avoids penalties, and can even provide financial advantages. Below, we outline the main conditions under which your business needs a VAT number in Estonia.Here are the key criteria for VAT number registration:

- Turnover Threshold – €40,000: If your enterprise’s taxable sales in Estonia exceed €40,000 in a calendar year, you are obliged to register for VAT. The moment your taxable supply (turnover from sales subject to VAT, not counting exempt sales) crosses €40,000 within the year, you must submit a VAT registration application to the Tax and Customs Board. In practice, you should apply within 3 business days of reaching the threshold. (It’s often wise to anticipate this and register slightly beforehand if you expect to exceed the threshold soon, to ensure compliance.)

- Intra-Community Acquisition of Goods – €10,000: In certain cases, even if your sales are below €40,000, you must register due to purchases from other EU countries. If your Estonian company (not yet VAT-registered) acquires over €10,000 worth of goods from other EU member states during a calendar year, Estonian law requires you to register for VAT. This rule ensures VAT is accounted for those cross-border goods acquired via intra-community transactions.

- Non-EU Businesses Selling in Estonia: Non-EU businesses with no permanent establishment in Estonia generally have no threshold – they must register for VAT before making any taxable supplies in Estonia. In other words, if a foreign company (e.g. from outside the EU) is planning to sell goods or provide certain services in Estonia, it needs an Estonian VAT number from the first sale. Moreover, a non-EU business is usually required to appoint a tax representative (fiscal representative) in Estonia as part of the registration. A tax representative is a local entity or person who is authorized to act on your behalf in VAT matters and is jointly liable for VAT – this requirement helps the Estonian tax authorities with compliance when dealing with overseas businesses. (EU-based companies do not need a tax representative, and can register directly.)

- Voluntary Registration: You may voluntarily register for VAT even before reaching the €40,000 turnover threshold. Many startups and small businesses choose to do this if they predominantly sell to VAT-registered clients or need to reclaim significant input VAT on investments. For example, if your company has not hit €40,000 yet but you purchase a lot of equipment with Estonian VAT, registering early lets you reclaim that VAT. Voluntary registration is subject to approval – you need to demonstrate a legitimate business activity. The Tax and Customs Board may require evidence (such as a business plan, contracts or invoices) that you are conducting or intend to conduct taxable business in Estonia. In certain conditions, the authority might refuse a voluntary registration application (for instance, if you have no actual economic activity or no customers in Estonia), so proper documentation and a clear business plan are important.

Note: If all the supplies of your business are VAT-exempt or 0%-rated (for example, exporting all goods or providing only financial services), you might not be required to register for VAT regardless of turnover. However, in such a scenario you also cannot reclaim input VAT, which could make voluntary registration unattractive. It’s best to consult on such certain transactions to decide the optimal approach.

How to Register for a VAT Number in Estonia

Registering for a VAT number in Estonia is a straightforward process, but it requires submitting an application and providing details about your business. Here’s an overview of the VAT registration process:

Where to Apply

All VAT number applications are handled by the Estonian Tax and Customs Board (Maksu- ja Tolliamet). You can apply in several ways:

- Electronic Application: The easiest method is via the Tax and Customs Board’s e-service portal (e-MTA). This online portal allows digital submission of the VAT registration application. To use it, the company’s representative needs to log in with a secure electronic ID – this can be an Estonian ID card, Mobile-ID, or e-Residency digital ID. (E-residents can conveniently log in from abroad using their digital ID card to apply.)

- In Person: Alternatively, you can submit the application in person at a Tax and Customs Board service office in Estonia. This might be practical if you are in Estonia and prefer face-to-face service.

- Through a Representative: If you are unable to apply yourself, you may authorize someone (for example, an accountant or lawyer from our company) to apply on your behalf. This requires a power of attorney. Our team often helps non-resident entrepreneurs by preparing and submitting VAT registration applications under power of attorney – a useful option if you’re abroad or unfamiliar with the process.

Information Needed

When filling out the application (online or paper), you will need to provide detailed information about your company’s activities. Be prepared to include:

- Company details: official name, registry code, legal address, contact information (phone, email).

- Business activity description: a brief description of what goods or services your company provides (or plans to provide) and the business model. Be clear about how your business will generate taxable sales in Estonia or the EU.

- Planned transactions and partners: if applicable, list some key prospective business partners or clients, especially those who are VAT-registered. The Tax Board often asks for examples of your expected customers or suppliers. Including their VAT numbers (for example, if you already have contracts or letters of intent with clients) can strengthen your application by showing real business plans.

- Projected turnover: an estimate of your expected sales turnover (even if it’s below the threshold initially) and an explanation of why VAT registration is being sought (for voluntary cases).

- Supporting documents: The Tax and Customs Board may request documents to verify your information. These could include contracts or agreements with clients/suppliers, invoices, purchase orders, proof of certain transactions in the pipeline, or a business plan.

After you submit the application, the Tax and Customs Board will review it. Registration applications are usually processed quite quickly – generally within 5 business days if everything is in order. In many cases, you might receive your Estonian VAT number in just a few days via the e-MTA system notification. However, if the tax authorities have doubts or need more information, they may reach out with additional questions or require further documentation. This can extend the review period. It’s not uncommon for the Tax Board to want clarity on your business plans, especially for new companies with no turnover yet – for example, they might ask for copies of contracts, invoices, or evidence of actual economic activity. Responding promptly and thoroughly will help avoid delays.

Once approved, your company will be issued a VAT number. The format for an Estonian VAT number is EE123456789 – it starts with the country code “EE” followed by nine digits. You can verify your VAT number (or any EU company’s VAT number) on the European Commission’s VIES website, which confirms the number is valid in the European Union VAT system.

After Registration: VAT Compliance and Reporting

Obtaining a VAT number is only the beginning. Once your company is registered as a VAT taxable person, you have ongoing obligations to charge, report, and pay VAT correctly.

Non-compliance or neglecting these duties can lead to penalties, so it’s important to understand what’s required. Here’s what you need to know about VAT returns and routine compliance in Estonia:

- Charging VAT and Issuing Invoices: From the date you are registered (or required to be registered), you must start adding VAT to all your taxable sales in Estonia at the appropriate rate (24%, 9%, etc.). You are also required to issue proper VAT invoices for each sale to business customers (and simplified receipts for retail sales). An invoice must contain your company’s name, address, and VAT number; the customer’s details (for B2B sales, include their VAT number if it’s an intra-EU sale); invoice date and number; description of goods or services; the VAT rate and amount, or a note if the sale is zero-rated or exempt. Invoice date is important because it usually determines the taxable period (month) in which that sale is reported. For continuous supplies of services or long-term projects, special rules apply: you should invoice at least once per calendar year (or at the completion of the service) so that VAT can be accounted for in a timely manner, as per the EU VAT Directive.

- Taxable Period and VAT Returns: In Estonia, the standard taxable period is a calendar month. This means VAT reporting is done monthly. As a VAT-registered business, you must file a monthly VAT return to the Tax and Customs Board for each month, even if you had no sales or purchases in that period (a nil return is required in months with no activity). The VAT return (sometimes called a VAT declaration) summarizes the amount of output VAT you charged on sales and the input VAT you paid on business purchases. It also calculates the net amount of VAT payable to the state or refundable to you. VAT returns in Estonia are due by the 20th day of the following month. For example, the VAT return for March must be submitted by April 20. This deadline also applies to paying any VAT due for that month – by the 20th, the payment should reach the tax authority’s account.

- EU Sales Listing (Report on Intra-Community Supply): If your company engages in intra-community supplies – for instance, selling goods to VAT-registered buyers in other EU countries or providing certain services across EU borders – you are required to submit an additional report, often called the VIES report or EC Sales List. In Estonia this is referred to as the report on intra-Community supply (KMD INF annex). It is filed monthly along with your VAT return (also due on the 20th) and it details the VAT numbers of your EU customers and the value of zero-rated sales to each. This reporting ensures transparency for cross-border trade between member states.

- Record Keeping: You must keep thorough records of your sales and purchase invoices, as well as any import or export documents, for at least 7 years (as required by Estonian law). Proper bookkeeping is essential for preparing accurate VAT declarations and is also required if the tax authorities decide to audit your VAT reports.

- Payment and Refunds: If in a given month your output VAT (the VAT you charged customers) exceeds your input VAT (the VAT you paid on purchases), you need to pay the difference to the Tax and Customs Board by the due date. Payment is usually done via bank transfer referencing your tax account. If your input VAT exceeds output VAT (for example, you had a lot of expenses or zero-rated sales), you will have a refundable VAT balance. Estonia’s tax authorities typically carry this credit forward to offset future VAT payable, or you can request a refund. VAT refunds are usually processed after some verification; the timeline can be a month or longer, and the tax authority may ask additional questions if the refund amount is significant.

- Penalties for Late Filing or Payment: It is critical to submit VAT returns on time and pay any owed VAT by the deadline. Late submission of a VAT return can result in warnings and ultimately a fine. Late payment of VAT will accrue interest – in Estonia, interest on late tax payments is 0.06% per day (which is about 21.9% annualized) on the outstanding amount, so it adds up quickly. The Tax and Customs Board has the right to enforce collection on unpaid taxes: measures include freezing your company’s bank accounts, seizing property, or involving a bailiff to collect the debt. Additionally, persistent non-compliance can damage your company’s reputation. Non-compliance records are public – information about overdue tax reports or tax debts of companies in Estonia is published in the public business register and on the Tax Board’s website. Company directors (management board members) are held responsible for ensuring that VAT obligations are met, so compliance is a serious matter.

- Input VAT Deductions: One of the benefits of being VAT-registered is the right to reclaim input VAT. You can deduct the VAT paid on goods or services your business purchases, to the extent those purchases relate to taxable (or zero-rated) outputs of the business. In practice, on each VAT return you subtract input VAT from the output VAT. If you have expenses like office rent, equipment, or supplies for your business operations, the 20% or 9% VAT you paid on those can be reclaimed against the VAT you owe. If some purchases are used partly for VAT-taxable business and partly for VAT-exempt or non-business use, you may only deduct the portion related to taxable activities (there are proportionate deduction rules in the VAT Act). It’s important to hold valid purchase invoices for any input VAT you claim, in case of inspection.

- Special Filing Schemes: The taxable period for most is monthly, but in certain conditions small taxpayers might be allowed or required to file quarterly (this is uncommon in Estonia, which generally sticks to monthly to keep reporting frequent). Always confirm your filing frequency with the Tax Board. Additionally, starting 2025, Estonia is introducing a special scheme for small businesses under EU rules, which may allow some small enterprises to simplify VAT obligations or even be exempt from VAT until a higher threshold. Keep an eye on new regulations if your business is small, as these can reduce compliance burden.

Special VAT Schemes and Arrangements in Estonia

Estonian VAT law, in accordance with the EU VAT Directive, provides several special schemes and rules that certain businesses can take advantage of (or must adhere to) under certain cases.

These schemes often simplify accounting or address specific industries. Here are some notable ones:

- Cash Accounting Scheme: Estonia allows a special cash accounting scheme for VAT, intended to help small businesses with cash flow. Under this scheme, a business may opt to account for VAT on a cash basis rather than the standard invoice (accrual) basis. This means you declare and pay VAT to the Tax Authority only when you actually receive payment from your customer, rather than when you issue the invoice. Similarly, you can only deduct input VAT on purchases when you have paid your supplier. This scheme is beneficial if you often have late-paying customers, as you won’t have to pre-finance the VAT. To use the cash accounting scheme, your company must meet certain conditions (e.g. your annual turnover must be below a set threshold, currently specified in the VAT Act). You also need to notify the Tax Board and mark “cash accounting” on each invoice you issue (as required by law) so that your customers know VAT is being accounted on receipt of payment. Most small local businesses qualifying for this scheme can take advantage of it, but it’s optional. Keep in mind, under cash accounting you also delay your right to reclaim input VAT until payment, so it’s a trade-off.

- Domestic Reverse Charge Mechanism: In Estonia, as in many EU countries, there are certain goods and sectors where a reverse charge mechanism is used domestically to combat VAT fraud or simplify reporting. Under a reverse charge, the VAT is not charged by the seller; instead, the buyer (if they are a VAT-registered taxable person) must self-account for the VAT on the transaction. Estonia applies a domestic reverse charge in certain transactions such as: scrap metal sales, certain metal products and precious metals, supply of construction services, sales of immovable property (real estate) if the seller has opted to tax the sale, and supply of investment gold (gold bullion) when a taxable person opts to tax it (investment gold is ordinarily exempt). For example, if your VAT-registered company sells scrap metal to another VAT-registered entity in Estonia, you would not add VAT on the invoice; instead, your invoice should state “reverse charge applies” and the buyer will declare both the output and input VAT in their own return. This mechanism is limited to B2B transactions – it does not apply to retail sales to consumers. The reverse charge helps prevent missing trader fraud in these high-risk items and simplifies cash flow since no actual VAT is exchanged between businesses for these supplies.

- One Stop Shop (OSS) for E-Commerce: If your Estonian company provides digital services or sells goods online to consumers in other EU countries, you should be aware of the OSS scheme. Under EU e-commerce VAT rules, certain transactions like digital downloads, streaming music content, or other electronically supplied services to non-business customers are taxed in the customer’s country. Rather than registering for VAT in every single EU member state, an Estonian company can use the One Stop Shop (OSS) special scheme. With OSS, you keep your Estonian VAT number but declare the VAT due in other EU countries through a special quarterly return submitted in Estonia. The Tax and Customs Board then distributes the tax to the respective countries. OSS greatly simplifies VAT compliance for cross-border B2C services and distance sales of goods within the EU. For example, if an Estonian e-shop sells consumer goods to customers in France and Germany above the small EU-wide threshold, it can report those foreign VAT amounts via OSS. Enrollment in OSS is optional but recommended if you have EU-wide online sales. (Prior to OSS, there was a “MOSS” for digital services and separate distance selling thresholds per country – those have been unified under OSS as of 2021.)

- Taxation of Immovable Property: As mentioned earlier, most sales of used real estate or rental of dwellings are exempt from VAT in Estonia. However, the VAT Act provides a special provision where a seller can choose to charge VAT on a property transaction (usually for business-to-business sales of real estate like commercial property or new buildings). If the option is exercised and certain conditions in the law are met, the transaction becomes taxable and the buyer can deduct input VAT. In such cases, a taxable person must inform the Tax and Customs Board in writing about the option to tax the sale before it takes place. The taxable supply of real estate then might also invoke the reverse charge (the buyer self-accounts for VAT) if both parties are VAT-registered. These rules are quite specific, so professional advice is recommended when dealing with property transactions.

- VAT on Imports and Customs Union: When importing goods from outside the EU into Estonia, VAT is typically paid at customs together with any customs duties. As Estonia is in the EU customs union, imports from other member states aren’t subject to customs controls, but imports from third countries are. If your company regularly imports, you might consider applying for deferred import VAT accounting or use customs warehousing to defer VAT. Also, exports (sending goods out of the EU from Estonia) are 0% VAT, but you must keep customs export documents as proof for your 0% rating. The Tax and Customs Board works closely with the EU customs authorities to ensure VAT and customs rules are followed for international trade.

In summary, Estonia’s VAT system has these special schemes to either alleviate financial pressure (cash accounting), simplify cross-border trade reporting (OSS), or prevent evasion (reverse charge). It’s important to evaluate if any apply to your business model. Our consultants can advise you on eligibility and implementation of any special VAT scheme to make sure you remain efficient and compliant.

International VAT Considerations for Estonian Businesses

Because Estonia is an EU member, local businesses often engage in cross-border commerce within the EU or beyond. Here are a few international VAT considerations and how having an Estonian VAT number plays a role:

- Intra-EU B2B Sales (Intra-Community Supplies): If your Estonian company sells goods to a VAT-registered business in another EU country, this is called an intra-community supply. With a valid VAT number on both sides (yours and your customer’s), you can apply a 0% VAT rate on the sale – effectively, it’s exempt from VAT in Estonia, and the customer will handle the VAT in their country (often via reverse charge). Your invoice must show your customer’s EU VAT number and typically mention “VAT 0% – intra-community supply.” Such sales must be reported in your VAT return and the monthly intra-community report (as noted earlier). This is a major advantage of being VAT-registered: without a VAT number, you cannot generally make VAT-free sales to EU business customers, which would hinder B2B trade.

- Intra-EU B2B Purchases (Intra-Community Acquisition): When your Estonian VAT-registered company buys goods or certain services from a supplier in another EU member state, they should 0% rate it on their side as an intra-community acquisition by you. You will then self-assess Estonian VAT on that purchase (declare output VAT and claim it back as input VAT on the same return, if it’s for taxable use, resulting in no net tax if done correctly). If you do not have a VAT number and buy goods from the EU, foreign suppliers might charge you their local VAT until you exceed the €10,000 acquisitions threshold – another reason to register if you do significant cross-border purchasing.

- Cross-Border B2C Sales of Goods: If your Estonian business sells goods online (distance selling) directly to consumers in other EU countries (B2C), be mindful of the EU-wide threshold for cross-border sales. As of 2021, the threshold is €10,000 for total EU-wide B2C sales (a small threshold that combines all countries). Above that, you are required to charge VAT in the customer’s country. The easiest way to comply is to use the OSS scheme described above. For instance, if you have an e-commerce store shipping from Estonia to customers all over Europe and your sales grow beyond €10k, you’d register for OSS and start collecting, say, German VAT for sales to Germany, French VAT for France, etc., but report it all through OSS with your Estonian VAT number. If you choose not to use OSS, you would have to register separately in each country once you exceed the threshold in that country (which was the old system). OSS greatly simplifies this, so most companies opt in.

- Providing Services Abroad: For Estonian service providers, VAT rules depend on the nature of the service and whether the client is a business or consumer, inside or outside the EU. Many B2B services fall under a general reverse charge: if you provide consulting services to a business client in, say, Germany, you would generally not charge Estonian VAT – instead, your invoice states “reverse charge” and the German client self-accounts for VAT in Germany. You still report it as an exempt (0%) service on your VAT return. For B2C services, the default is to charge Estonian VAT (because the “place of supply” for services to a non-business client is usually the seller’s country). However, there are notable exceptions: digital electronic services (like mobile apps, streaming music content, or other online content delivery to consumers) are taxed where the consumer is located – hence the need for schemes like OSS. Also, certain services related to immovable property are taxed where the property is (e.g., architect services for a building in Estonia are taxed in Estonia).

- Transactions Outside the Scope: Some activities might be outside the scope of VAT entirely (neither taxed nor counted toward the threshold). Examples are grants, donations, or sale of a business as a going concern. These typically don’t require VAT registration, but if you have a mix of such revenue and taxable revenue, rules can get complex – an advisor can clarify based on the Estonian VAT Act and EU law.

- Coordination with Income Tax: While VAT is a separate system from profit taxes, running a business means dealing with both. Estonia’s corporate taxation is unique (0% reinvested profits, taxed only on distributed profits as per the Estonian Income Tax Act). Ensure that becoming VAT-registered and doing VAT accounting is integrated with your general accounting. For example, certain expenses might be non-deductible for income tax but still reclaimable for VAT, and vice versa. A good accountant will manage these nuances so that Estonian tax compliance is maintained on all fronts.

International VAT compliance can be one of the trickier aspects of doing business across borders. However, once your Estonian company has its VAT number and you understand the frameworks (like intra-community rules and OSS), it becomes routine. Our team can help navigate these cross-border scenarios so you apply the correct VAT treatment for every sale or purchase, avoiding costly mistakes.

Contact Us: Get Assistance with VAT Registration

VAT compliance can feel overwhelming, especially for new businesses or foreign entrepreneurs. The good news is you don’t have to handle it alone. Eesti Firma’s experienced accountants and consultants are here to help you at every step – from obtaining an Estonian VAT number to ongoing VAT reporting and general accounting support.

We offer professional guidance to ensure your VAT registration application is successful, even in complex situations for e-residents or non-EU businesses. After registration, we can take care of your monthly bookkeeping and preparation of VAT returns, making sure all transactions are properly recorded and your VAT returns are filed correctly and on time. We also advise on special VAT schemes, compliance with the Estonian VAT Act, and how to minimize risks of non-compliance or late payment issues.

The additional information about our full range of accounting services is available on the topic page of our website. We encourage you to check it out to see how else we can support your business in Estonia. Getting your VAT number is just the first step – with proper accounting and tax support, you can focus on growing your business while we handle the compliance.

FAQ | Frequently Asked Questions

Below we answer common questions our consultants receive about VAT registration, compliance, and reporting in Estonia. These answers will help you navigate the obligations of a taxable person and avoid mistakes in dealing with Estonian tax authorities.

- What is a VAT number and who needs it in Estonia?

A VAT number in Estonia is an identification code used for value added tax purposes. It begins with the prefix “EE” and is followed by nine digits. If your taxable supply exceeds the threshold of 40,000 euros during a calendar year, you’re required to register for VAT. In some cases, you must register even before reaching that threshold—for example, if you’re involved in intra-Community acquisition of goods or distance sales to Estonia.

- How can I check if a company is VAT-registered in Estonia?

You can verify any Estonian or European Union VAT number via the EU’s VIES (VAT Information Exchange System). The data is exchanged in real time between the tax authorities of different member states.

- Which law regulates VAT in Estonia?

VAT in Estonia is governed by the Value Added Tax Act. This legal act defines rules for supply of goods, exempt supplies, input VAT, registration obligations, and refunds. Estonian tax and customs authorities ensure compliance with this law.

- When must I register for VAT in Estonia?

The obligation to register as a taxable person arises when the value of your taxable supply exceeds the 40,000-euro threshold during a calendar year. However, companies from other countries (including non-EU countries) may be required to register even earlier if they supply goods or services within Estonia.

- Can foreign companies register for VAT in Estonia?

Yes, foreign companies—including non-EU companies—may register for VAT in Estonia if they are engaged in business here. If you do not have a permanent establishment in Estonia, you may need to appoint a fiscal representative authorized to handle VAT matters on your behalf.

- How are VAT reports filed and submitted in Estonia?

VAT returns must be filed electronically through the e-services portal of the Estonian Tax and Customs Board. The reporting period is a calendar month, and the report must be submitted no later than the 20th day of the following month. The data can also be entered manually or submitted in .csv format.

- What happens if I miss the VAT reporting deadline?

Failure to submit the report on time may lead to warnings and penalties from Estonian tax authorities. Board members of the company are personally responsible for timely and accurate filing. Repeated delays may damage your reputation with Estonian public institutions and affect your tax standing.

- Do foreign companies need to register for VAT in Estonia?

Yes. Foreign companies—including those from a non-EU country—may be required to register for VAT in Estonia if they supply goods or services within the country. The registration obligation arises even without a permanent establishment in Estonia, especially when the place of supply is Estonia. In such cases, appointing a fiscal representative or authorized person is often required.

- Is there a simplified process for distance sales to Estonia?

Yes. If your business is based in another EU member state and supplies goods to Estonian consumers, you can register through the One Stop Shop (OSS) scheme in your home country. This allows you to report VAT for all EU countries through a single VAT return. However, if you use an online marketplace, that platform may become the person liable for VAT in some cases.

- What is the VAT liability of foreign companies operating through online marketplaces?

In many cases, online marketplaces are responsible for collecting and remitting VAT on behalf of sellers. Still, foreign companies using such platforms must ensure compliance with Estonian VAT obligations. They must verify whether they are required to register for VAT in Estonia or another EU country under OSS rules.

- How long does the VAT registration process take?

The VAT registration process in Estonia is relatively fast and is typically completed within three working days, provided all required documents are submitted correctly. Registration must be done electronically, and data can be entered manually or uploaded in .csv format via the Estonian e-services portal.

- What is the reporting period for VAT in Estonia?

The standard reporting period is a calendar month. VAT returns must be submitted by the 20th day of the month following the taxation period. All the taxable supply, input VAT, exempt supplies, and intra-community acquisitions must be declared in accordance with the Estonian VAT Act.

- Can I get help with VAT compliance in Estonia?

Absolutely. Our VAT experts can guide you through every step—from registration in Estonia to ongoing reporting and VAT refunds. Whether you’re handling intra-community distance sales, operating from a foreign country, or need to register as a taxable person, we’re here to assist.